Listing classification graveyard

Think about the last time you made order in your papers or did some kind of filing on your computer. You sorted most of your files into their respective folders until you were stuck with some files which you did not know where to put, so you created a folder called "Other" and put all your remaining "I have no better place for these" files in there. Order was restored.

As you repeat this operation over and over again the "other" folder starts to swell. It contains more and more files, until you need to make some order in this folder. If you don't do this - after some time it will be difficult to find anything there.

Now think about a marketplace. In a similar way, hundreds of millions of listings are sorted into different categories every day. Each listing must be sorted somewhere. In a normal case - it will go where it belongs - a pen listing to pens category and a shoe listing to shoes category. In a worse case, a pen will go into shoes and in the worst case a pen will go into "other".

This "other" category will probably remain the final resting place for this listing - never to be seen again by any potential buyer.

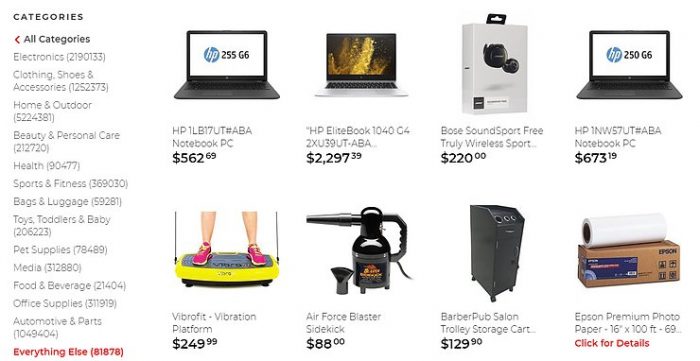

Miscellaneous category on Shopzilla shopping comparison site

Generally, the responsibility for the classification of the listings lies with the seller. Indeed, small sellers that have only a few hundreds or thousands of listings will list them very carefully and usually ensure proper placement into correct categories. However for big sellers it's a different story. Consider a seller with 200K SKUs who needs to list them on 3-5 marketplaces. This means he has to do 600K-1M mappings. Moveover, every day thousands of new SKUs are added to the inventory. For a big seller the task of listings classification never stops. Now, add to this occasional category structure changes initiated by marketplaces and the process became even more complex. Since sellers cannot submit listings to the marketplaces without classifying them first, sellers make their life easier by simply marking some of their listings to go to some kind of "other" category. This is very similar to the process of filing described at the beginning. The marketplace "Other" bucket category is born.

Usually, marketplaces work very hard to create sophisticated category structure and navigation features. These navigation features are connected logically to the category structure, so when the user lands in the shoes category - he or she can use this navigation to quickly filter and select shoes of the right size and desired color. Every product category on the marketplace has a set of attributes associated with the products inside. It’s possible because all products in the category share the same basic features or attributes. Any shirt can be characterized by a certain color or material and any digital camera can be characterized by a sensor size.

Clearly, this attribute set can not be set for a bucket category, simply because the bucket category contains all kinds of listings. Since the navigation attribute set cannot be created - no filtering of listings in the category is possible.

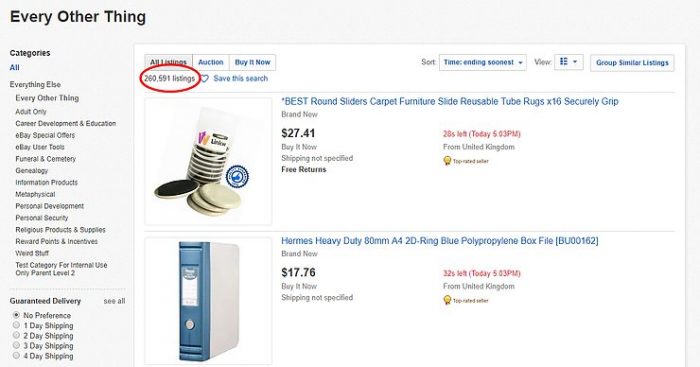

"Other" category on ebay.com. Only a small portion of over 1B live listings.

Most marketplaces solve this problem in a very simple way - they just hide the "other" categories from the user. Hence on most marketplaces the listing in the "other" bucket becomes immediately invisible. The marketplaces that do expose these categories, which contain the most heterogeneous set of listings, simply are not able to provide any helpful way of navigation or filtering. In both cases of hiding or showing of the "other" categories the buyers vote with their clicks. Any listing that lands inside the "other" category is basically located at the graveyard of the marketplace, never to be seen and never to be purchased.

Now the question is how many listings end up in these "buckets". If it is just a small fraction - the effort of dealing with the problem is not worth the investment, but anything over 0.5-1% of the total volume of listings is already considerable for a large marketplace.

The numbers vary between marketplaces, and go from 0.05% in some marketplaces up to 40%. This is a lot listings and a lot of potential lost. One thing to keep in mind not all "other" categories are the same. While "Home" -> "Other" is a bucket, "Home" -> "Furniture" -> "Chairs" -> "Other" is more acceptable, though still underperforming in terms of conversion.

The look on the flipside of the marketplace - the seller feed, reveals the source of the problem. The most radical example was found in a feed of one of the largest sellers in Japan. The feed contained 314K listings and 211K (59.4%) of them were pre-classified by the seller to some kind of "other" category on the target marketplace. Out of these 211K, 113.5K listings were pre-classified to "Home"->"Other". In this particular case it is clear that an improvement of preclassifiction on the seller side will dramatically improve the discoverability and the subsequent conversion to sale.

"Other" category on Rakuten.com. More "Other" subcategories inside the category tree.

While pre-classification of a listing feed is the responsibility of the seller, the marketplace can and should take action, which will benefit both the marketplace and the seller. Every marketplace should have some criteria set for the amount of listings they allow inside the "other" bucker and once this amount is exceeded take action. This action can be a reclassification of the listings executed in the background or if this cannot be done at least notification of the seller about a loss of potential. Moreover, marketplaces can assess the value of each seller to the marketplace. The quality of content and specifically the quality of listing classification done by the seller can serve as one of the parameters in such assessment.

As a bottom line both the seller and the marketplace should make an effort and fix this situation. In most cases neither the marketplaces nor the sellers are even aware of how bad the situation is and how big is the loss of potential. Once the damage control is done there are many ways to fix this "leaky bucket". Better classification systems on both sides, systematic approach and constant monitoring will remove the listings from the "other" categories and put them where they really belong. There the buyer will find them and will have a chance to buy them. The upside of the proper classification is immense.